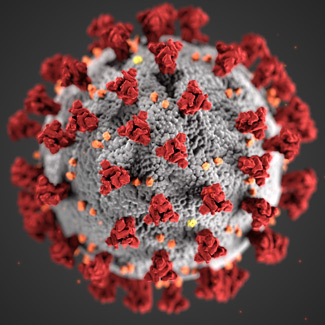

The global fallout from the miserable phytosanitary conditions at the Huanan Market in Wuhan, China, will change the fortunes of the twenty-first century. The countries at the center of the global economy, especially the eurozone, are now heading not only toward being at the receiving end of the worst pandemic since the Spanish flu of 1918–20, but also toward the abyss of an unprecedented economic recession. Amidst all this, in March 2020, the core of the European Union’s neoliberal fiscal policy framework, the Maastricht criteria, were put out of action. But what will follow next?

The global fallout from the miserable phytosanitary conditions at the Huanan Market in Wuhan, China, will change the fortunes of the twenty-first century. The countries at the center of the global economy, especially the eurozone, are now heading not only toward being at the receiving end of the worst pandemic since the Spanish flu of 1918–20, but also toward the abyss of an unprecedented economic recession. Amidst all this, in March 2020, the core of the European Union’s neoliberal fiscal policy framework, the Maastricht criteria, were put out of action. But what will follow next?

Italian Prime Minister Giuseppe Conte has already called, with good reason, for special “corona bonds” to help EU states finance desperately needed health spending and economic rescue programs. With 20,465 coronavirus deaths as of April 14, 2020, Italy has ample reason to call for such “corona bonds.” The same applies to the other most seriously affected EU countries, Spain (18,056 deaths) and France (14,967 deaths). The idea is also welcomed by a growing number of leading global economists—but not by Austrian Federal Chancellor Sebastian Kurz, one of the European leaders whose country and whose banks, like those of Germany and the Netherlands, were among the absolute winners in the eurozone redistribution of wealth since the 2008 crisis, to the detriment of the European South. Kurz, in many ways now the absolute trendsetter of center-right politics in Europe (at the pace that Germany’s Angela Merkel, by her perennial indecisiveness, leaves an ever bigger vacuum), was very quick to refer the suffering in Italy back to the same old European Stability Mechanism (ESM) that already caused so much stagnation in the European South since 2008.

It is no joke in this context that the last verse of the Italian national anthem refers to Austria as the ultimate “bad guy” in history, shedding the blood of Italians and Poles. In the evolving clash of ideas regarding how to come out from the crisis, we also have to refer to Austrian-born Nobel laureate Friedrich August Hayek (1899–1992), who back in 1939 laid the foundation for neoliberal economic policymaking in Europe (reprinted in his collection Individualism and Economic Order): Hayek explicitly welcomes the downward pressure on wages and social conditions in a union of states. Hallelujah.

So, no eurobonds, no reconstruction after the present coronavirus crisis, and the resurrection of the Maastricht criteria and the savings packages instead?

For the empirical observer, it is clear from IMF data that prolonged budget surpluses were extremely rare in the world economy. Great Britain had achieved them between 1988 and 1990, as well as the international financial centers Singapore and Luxembourg, and the oil economies of Kuwait and Norway. Military dictators in Myanmar and Chile and the communist dictator in Romania before 1989 brought them about. The last government in this queue was Yugoslavia before it collapsed in 1989.

But why are Maastricht, the ESM, and the rest so wrong? Saving the honor of the Austrian economics profession, Kazimierz Łaski (1921–2015) pointed out that the private sector of the entire global economy displays a sustained tendency to save more than it invests. Łaski’s logic is compelling: growth can only be generated by an increase in private investment or by deficit spending or by foreign trade surpluses or by a reduction in the savings rate. Stephan Schulmeister, another Austrian economist uninfected by the neoliberal virus, quite correctly added that the European Union’s austerity packages made the European South poorer. The ESM prescribes decades of austerity. But politicians and their cabinets usually do not read the small print of anything, let alone of such regulations, and they really do not care about “natural rates of unemployment” and other elements of these financial torture chambers.

The current pandemic really threatens to become the primary catastrophe of the twenty-first century. The Italian economist Giovanni Andrea Cornia has proven that not only epidemics kill but so too do economic crises. Cornia concludes that from 1989 to 2014, 18 million people in the region of Eastern Central Europe and the former Soviet Union fell victim to economic shock therapies. The neoliberal set of rules, which determined Europe’s path since the 2008 crisis, had similar devastating effects already. Applying Cornia’s methodology to World Bank data, we must conclude that the 2008 crisis and its aftermaths led to the death of 1.76 million people in the eurozone (based on World Bank data).

Putting Italy and Spain, after all the present and past sufferings, back into the same cage of the European Stability Mechanism will be a fatal decision that will serve as a fire accelerant of resistance against European Monetary Union, possibly leading even to the Italexit from the European Union and the very national disintegration of the Spanish state. Sebastian Kurz and other European leaders thus would do well to reflect on verse five of the Italian national anthem, which says that “already the eagle of Austria has lost its feathers.”

Arno Tausch is Honorary Associate Professor of Economics, Corvinus University, Budapest, Hungary, and Adjunct Professor of Political Science at Innsbruck University, Austria.